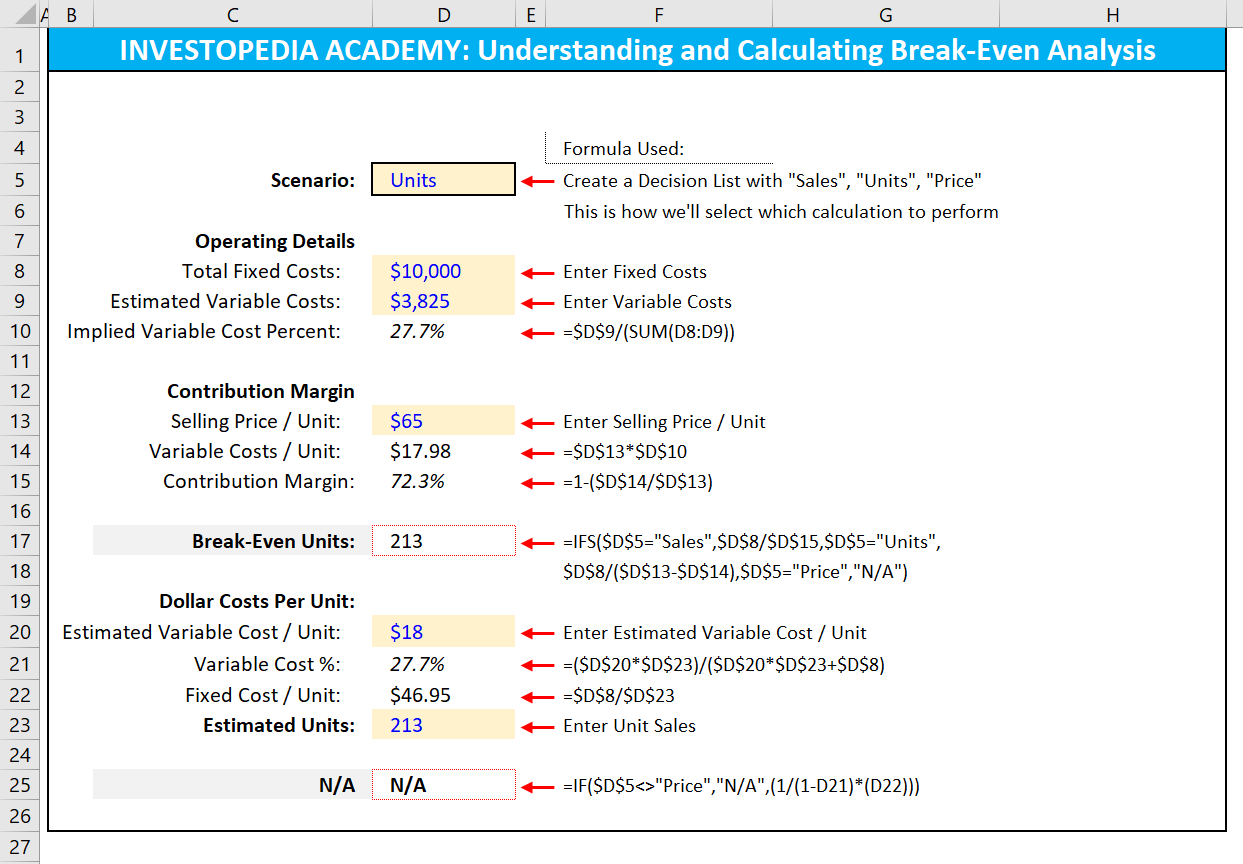

Their fixed costs, including bills, payroll and rent, total $300,000. This calculation tells you how many units of a single product you need to sell to break even.īreak-Even Point = Fixed Costs ÷ (Sales Price Per Unit − Variable Costs Per Unit)įor example, a cosmetic company wants to know how many lipsticks from their line they have to sell to break even. Calculating the break-even point in units

There are two common ways to calculate the break-even point based on your needs: in units or sales dollars.ġ. Contribution margin: the difference between the sales price per unit and the variable cost per unit.Variable costs per unit: variable costs for each unit, as opposed to the total variable costs.Sales price per unit: the price at which your unit or service will sell to customers for each individual product.Variable costs: expenses that fluctuate in proportion to production output or sales (e.g., materials and shipping).Fixed costs: costs that do not change with sales or volume, with little fluctuation (e.g., monthly rent or interest payments).

BREAK EVEN POINT FORMULA FOR UNITS HOW TO

Let's go over how to calculate a break-even point using two different methods.īefore you calculate your BEP, you need to understand a few basic financial terms used in the formula: It's also a useful figure to keep in mind when managing prices, operating costs and overhead. The break-even point is more than the moment when you pop a celebratory bottle of champagne. Calculating the break-event point (BEP) is a useful tool to determine when your product will become profitable. The BEP is the point at which your total costs and total revenue are equal. Turning a profit is the goal of every business, but it doesn't happen overnight.

0 kommentar(er)

0 kommentar(er)